Leadership and Risk: Can it be measured?

One’s risk profile, or natural comfort with taking risks, is important to consider when hiring at all levels of an organization, especially when hiring at the executive level. Consider the numerous examples we have seen over the years when misjudging a situation has caused great harm – we can think of examples in financial services, energy, transportation and more. Taking on too much risk can have dire consequences, as can embracing too little risk.

Here are two major errors a business leader can make; consider how the natural behavioral style of the leader will indicate which of these errors s/he is more likely to make:

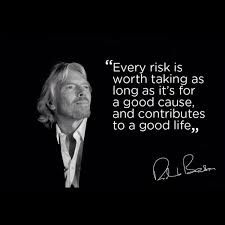

You sunk the boat! A leader who is too aggressive, too willing to make decisions on too little evidence, too comfortable taking a gamble, or willing to take the leap despite not having all the information are leaders who can cause great harm to a company by making poor decisions. Clearly Sir Richard Branson is an example of a leader with huge vision and a high comfort with risk.

You missed the boat! This type of error comes from not being willing to make hard decisions because of extreme cautiousness, and it can create situations where an organization fails to capitalize on an opportunity. In today’s business environment with such fast-paced and constant change, the leader who sits still or is overly conservative runs the risk of making their organization become obsolescent overnight. If you are old enough to remember Wang Labs, you might recall that their lack of foresight when the original word processors were being replaced by personal computers doomed the company.

Examples of the significance of one’s risk profile are easy to find in daily life. Consider the corporate controller who needs to take things “by the book,” or the school bus driver who must drive the same route every day taking kids to school. One wouldn’t want those with high risk profiles doing these jobs. But a leadership team in a new tech startup should better be willing to take some chances; sometimes “ready-shoot-aim” behavior is what it takes to win.

Predictive Index behavioral assessments have worked in most industries for over our 60 years, these assessments.

Have seen some trends: bankers and many in financial services tend to have a conservative approach to business, as do doctors, nurses, and leaders in heavily regulated industries. Whereas those on the edge of technology, those who are cold calling on prospects, and individuals and teams who are charting new courses and finding new ways to solve problems, tend toward the opposite end of the risk taking spectrum.

These are very broad-brush generalizations, and on leadership teams it is often best to have people with a variety of profiles working together. The conservative ones keep the big risk-takers from jumping too quickly, and the risk-takers push the risk-avoiders to take action. In a well-honed team (where people appreciate one another’s differences) these different approaches can work very well. But in positions like the bus drivers or outside sales people, there is usually one best risk profile, and hiring to match that will have a real impact on their success.

This risk-profile is one of the fundamental pieces of information quickly provided in The Predictive Index’s Behavioral Assessment can provide insights into and the individuals risk pattern.

Want to learn more about creating a well-honed team with risk-prone and risk averse members? Learn how behavioral analytics can now be applied at the group level to improve performance and business results.

Written by Sue Blaney